Year in Review

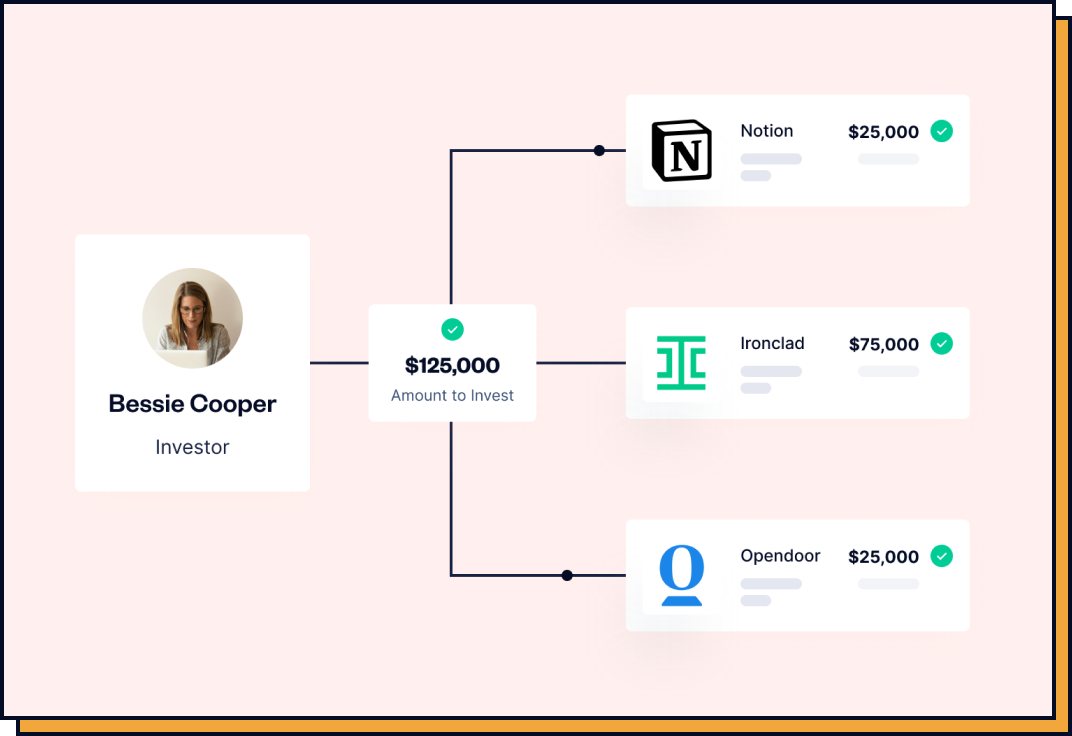

AngelList exists to increase the number of successful startups in the world. In

service of that mission, we spun out

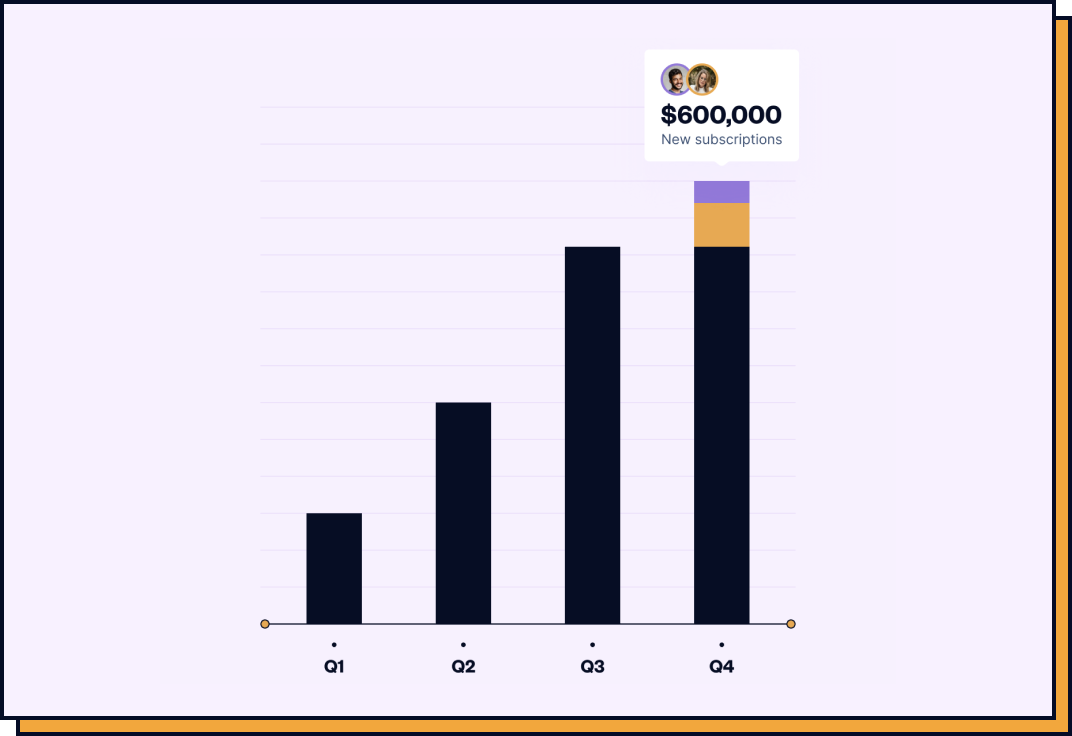

AngelList Venture as its own independent company from AngelList Holdings at the start of 2020. Then we launched

Rolling Funds, Transfers, and a Fund Performance Calculator. Our

goal? Serve

founders by eliminating the hassles associated with venture investing.

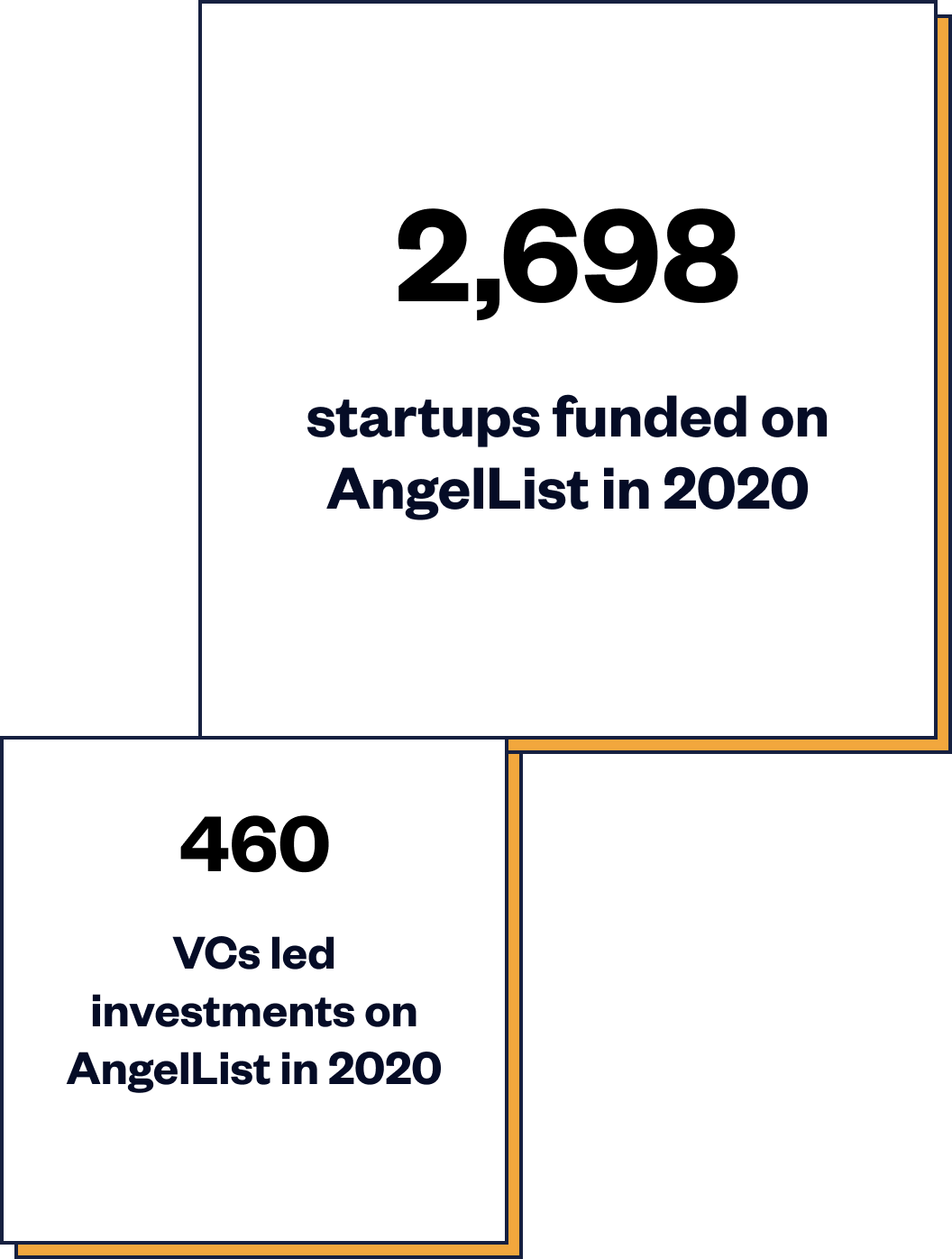

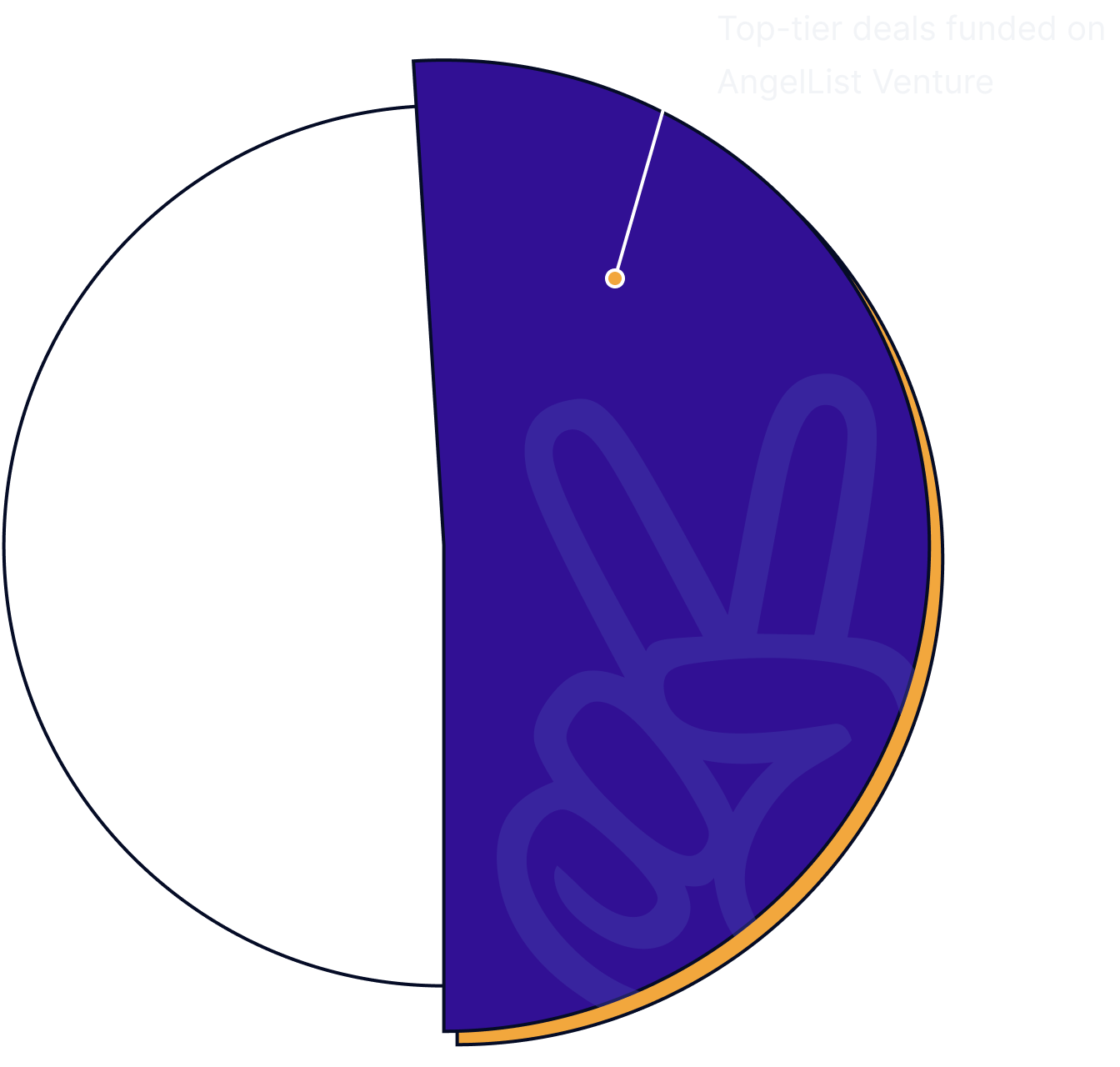

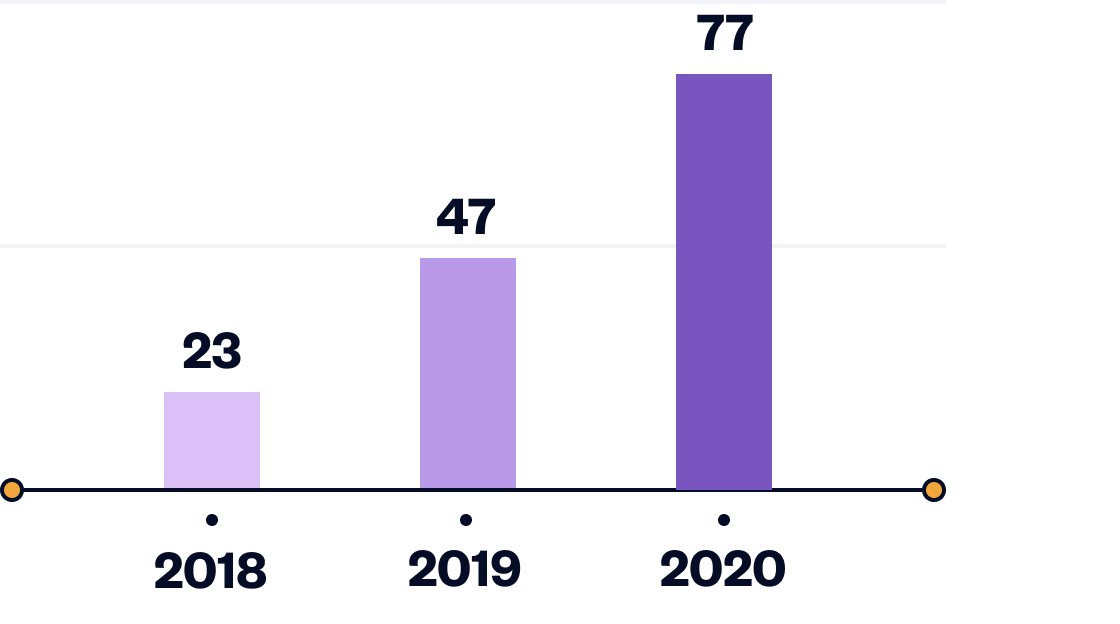

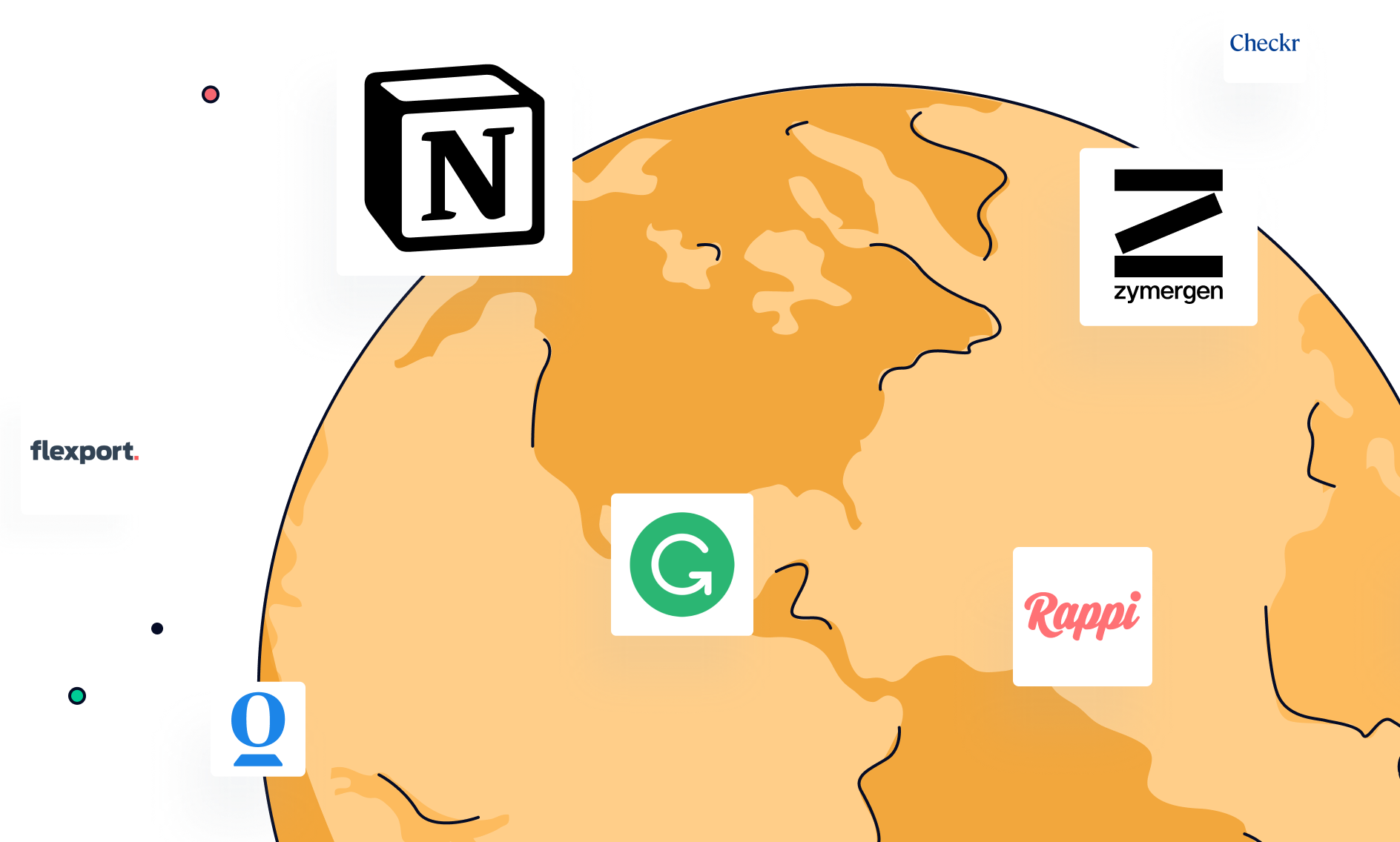

We now support over $2.5B in assets under management, 77 unicorns backed by

AngelList Funds & Syndicates, and 51% of all top-tier U.S. VC deals in our portfolio. All of which is to say

2020 was truly a breakout year for AngelList Venture. And we’re just getting started…