Relay—smart portfolio management

Benefits

Transform scattered portfolio data into a central source of truth. AngelList Relay integrates with your inbox to parse documents and portfolio company updates, centralizing complex workflows and simplifying recordkeeping.

Features

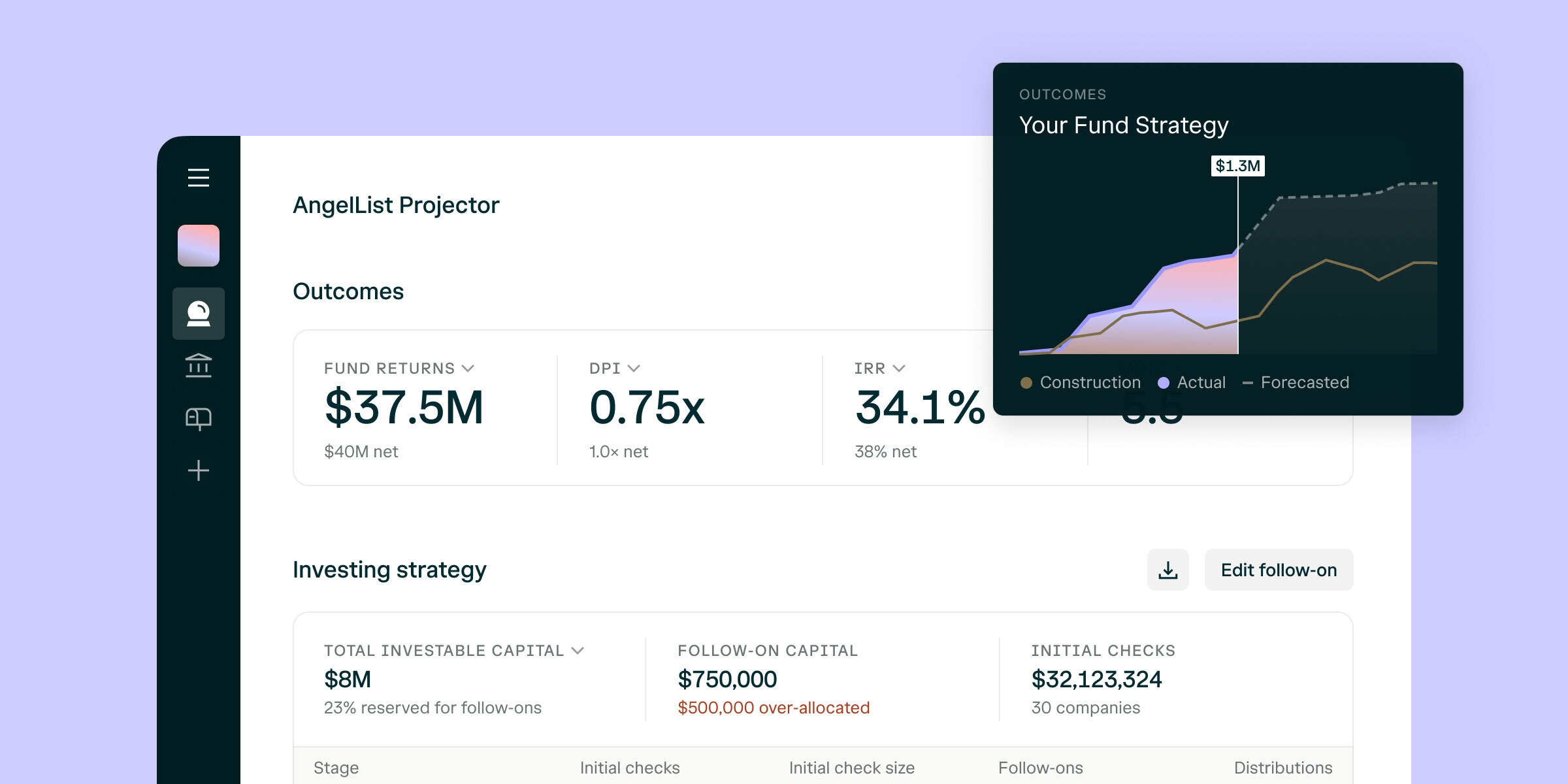

Portfolio tracking dashboard

View investment information and company performance within a centralized dashboard–providing a holistic view of your portfolio at a glance. Relay's AI technology helps you maintain your portfolio dashboard by parsing directly from your inbox or uploaded documents, allowing you to easily reveal data insights and collaborate seamlessly across your firm.

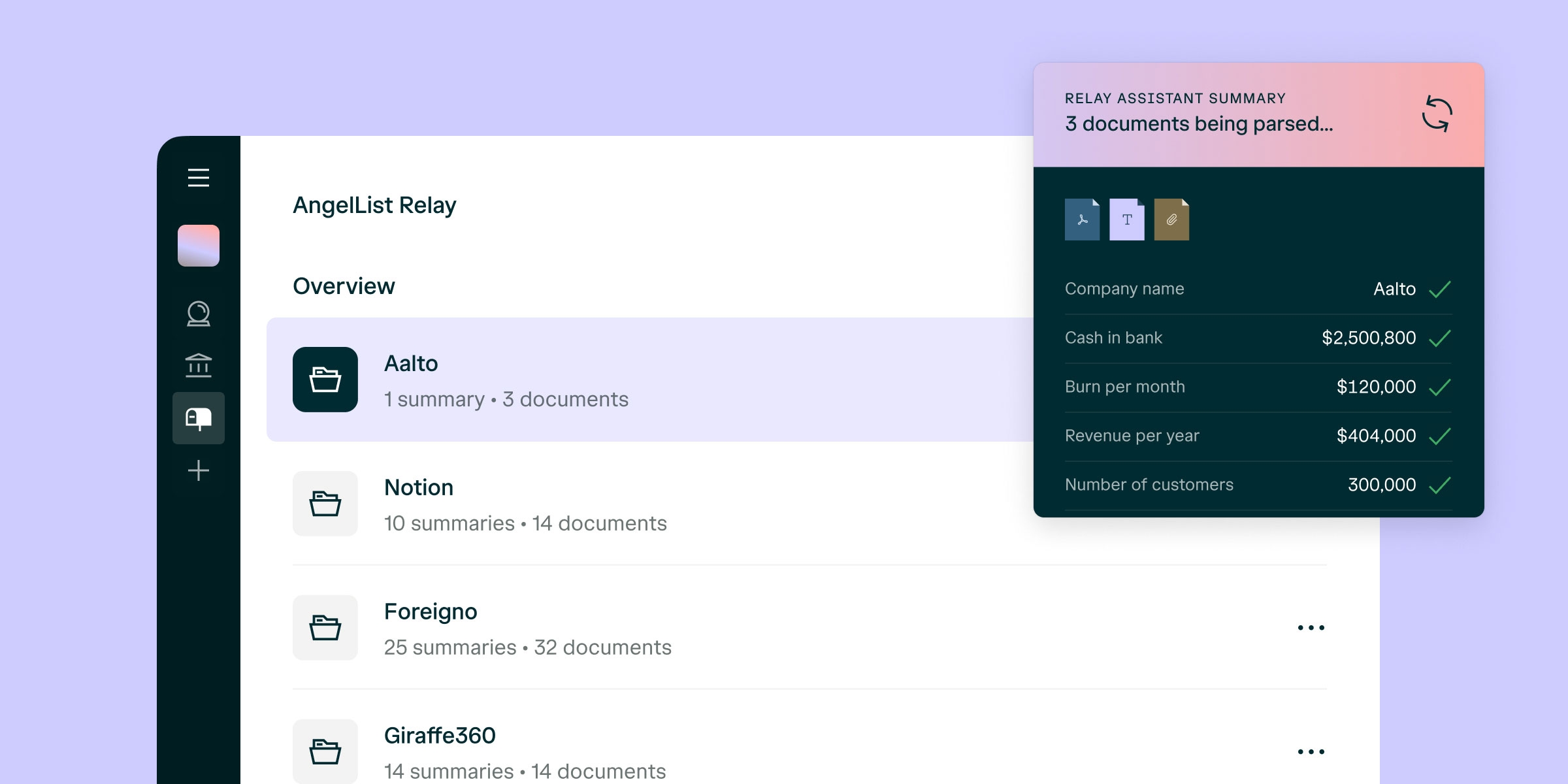

AI-powered term extraction

Forward investment documents and unstructured investor updates from your portfolio companies to your Relay email address. Relay automatically extracts key details such as pay-to-play provisions, revenue metrics, burn rate, and 41+ other terms as structured data. Receive an AI summary with key data via email in less than 5 minutes.

Valuation management

Manage valuations across your portfolio and keep track of supporting evidence that can be easily exported for auditors. Proactively monitor company updates and automatically identify smart relationships between data points, making it easy to stay on top of valuation updates.

SOI reconciliation

Confidently keep your own set of books while collaborating with service partners directly within your dashboard. Relay can parse and verify the contents of any Schedule of Investments (SOI) in real time to compare against your portfolio.

Remove the manual process from managing portfolio company updates and investment documents

AI SummaryEmailed within 5 minutes and added to your dashboard

65+ TermsParsed from company updates and investment documents

Team AccessMulti-level team permissioning

Automated DashboardFund and company level insights

Testimonial

Relay enables me to scale my firm through software so my team can focus on the most strategic initiatives and working with our GPs. I can access portfolio data with ease as it’s directly linked to all of our docs and portco updates.

—Ken Aseme, CEO at Hazic Fund Services

Pricing

Tailored to your needs

One portfolio management software solution across all your funds that provides you with

- Centralized collaborative dashboard consolidating investment data and portfolio company performance KPIs

- Automatically parsed investment legal documents, company updates and stored emails

- Unlimited Relay addresses and team members

- Valuation management features

- SOI reconciliation

- OpenAPI available

*For existing AngelList customers, please reach out to your account manager for more information.

FAQ

Everything you

need to know

Relay can programmatically review, store, and organize any of the documents below, provided the document includes the company’s legal name, fund’s legal name and the document is in a DOCX or PDF format.

Supported documents include: board consents, certificates of incorporation, convertible notes, participation notices, pro rata side letters, rights agreements, rights offerings, SAFEs, stock purchase agreements, stock transfer agreements, token warrants, voting agreements, wire instructions, investor rights agreements, and right of refusals.

Note: Relay can parse document attachments and any text stored in the body of an email. However, when content cannot be associated with a portfolio company on your dashboard, it will still be accessible but will be stored in the “Unsorted” section.

Relay currently parses the following terms from the indicated document types.

Stock Purchase Agreements: Company name, investment date, investment type, pay-to-play provisions, round, valuation amount and currency, valuation type (pre-money/post-money), your fund’s total shares, purchase price, and currency (if applicable)

SAFEs: Company name, discount (if any), investor name, investment amount and currency, investment date, investment type, pro rata rights, round, valuation cap and currency, valuation type (pre-money/post-money)COIs: Company name, state of registration, authorized shares, share class, amount of shares you hold, designations, preferences, rights, limitations

IRAs: Company name, pro rata rights, whether or not pro rata rights require major investor status, information rights, information rights, cap table information rights, quarterly and annual financial statements information rights, whether major investor status is required for financial statements/budgeting/plans, inspection rights, whether major investor status is required for inspection rights, IPO lock up period (if any).

Relay can parse the following terms from any company update found in an email body, in DOCX format, or PDF format:

Annual revenue, revenue currency, burn per month, cash in bank, number of customers, whether or not the company is raising a new round, the description of the new round that the company is raising, a summary of the business updates, and a summary of the product updates.

User Personal Identifiable Information (PII) is managed in accordance with our Privacy Policy.

If you enable Relay email sync, you are authorizing AngelList Relay to access your entire inbox to scan for potentially pertinent emails and parse the contents (and any attachments) of those emails. The parsed information will then be imported to your AngelList Relay account. You may revoke this access at any time.

AngelList Relay will not share your legal documents or the information contained within those documents with other investors.

AngelList uses AWS with services like S3 for object storage and RDS for relational database management. AngelList also employs encryption at rest and in transit, access management through IAM roles, regular vulnerability scans, and is SOC 2 compliant.

AngelList will not use your data for any purpose other than providing you the Relay services and as described in our privacy policy.

For any additional questions, please reach out to relay@angellist.com

Ready to experience AngelList Relay?

Get started with AngelList Relay and consolidate scattered portfolio data into a central source of truth. Remove the manual process of tracking, organizing, and maintaining your portfolio.